Will Sodium Batteries Overturn Lithium Batteries' Dominance?

Will Sodium Batteries Overturn Lithium Batteries' Dominance?

Jan 20, 2026

What is the current state of the global sodium battery industry? Will it reshape the current market landscape dominated by lithium batteries? Regaining Market Attention Sodium batteries are rechargeable batteries that use sodium ions (Na+) as charge carriers. They operate primarily by the movement of sodium ions between the positive and negative electrodes, functioning similarly to lithium batteries. In reality, sodium batteries are not a novel concept. Research into sodium batteries began almost simultaneously with lithium batteries in the 1970s. However, development stalled due to constraints in research conditions and other factors. Meanwhile, lithium batteries rapidly gained traction, achieving comprehensive coverage across consumer electronics, computers, communication networks, electric vehicles, and other sectors. The current surge in battery raw material prices is placing immense pressure on rapidly expanding power battery manufacturers. Data indicates that the spot price of lithium carbonate averages around 89,000 yuan per ton, representing a roughly 67% increase since the beginning of the year. Similarly, the spot price of lithium hydroxide averages approximately 89,500 yuan per ton, surging by 80% year-to-date. This price hike is primarily driven by the rapid expansion of the electric vehicle and energy storage markets, which have fueled a sharp increase in demand. Approximately 70% of the world's lithium resources are concentrated in South America, while China relies on imports for 80% of its lithium supply. To address this critical resource constraint, relevant companies are turning their attention to sodium batteries. It is understood that sodium batteries primarily use sodium salts as electrode materials, which are more abundant and less expensive than lithium salts. “Sodium chloride can't be hyped up because there's so much salt,” stated Zeng Yuqun. Currently, about 20 companies worldwide are engaged in sodium battery R&D, including UK-based Faradion, Japan's Kishida Chemical, US firm Natron Energy, and China's Zhongke Haina, Sodium Innovation Energy, and Starry Sky Sodium Battery. In June 2018, Zhongke Haina launched China's first sodium battery-powered low-speed electric vehicle, marking a new chapter in sodium battery development. Industrialization Faces Challenges Like Stability “Sodium batteries can utilize existing lithium battery materials, cell production processes, and manufacturing equipment, presenting no significant bottlenecks for mass production,” Hu Yongsheng, a researcher at the Institute of Physics, Chinese Academy of Sciences, told reporters. Sodium batteries have gradually transitioned from laboratory research to practical applications. China currently leads globally in sodium battery product R&D, manufacturing, standardization, and market promotion, with the industry poised for commercial deployment. So, will sodium batterie...

View More

How to Increase the Power Output of Residential Distributed Photovoltaic Power Station?

How to Increase the Power Output of Residential Distributed Photovoltaic Power Station?

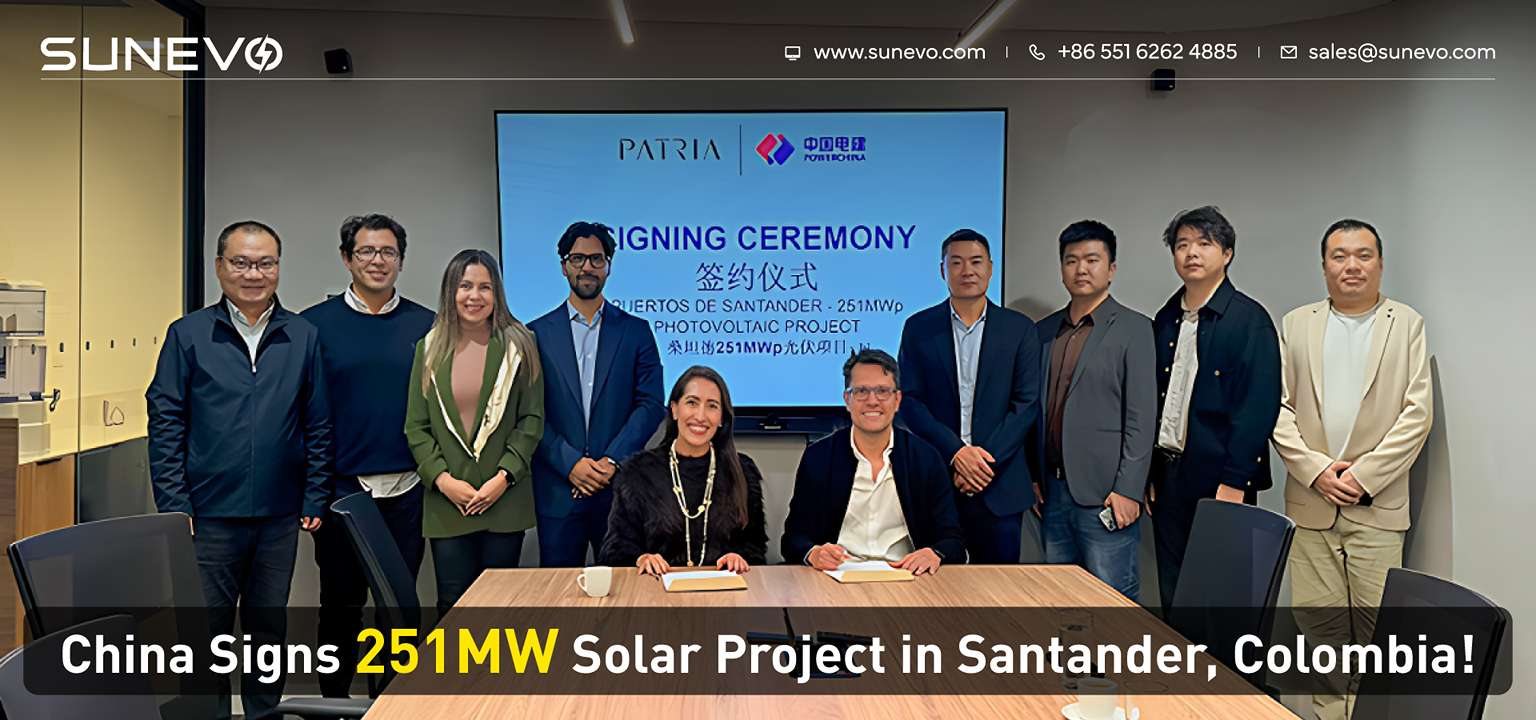

China Signs 251MW Solar Project in Santander, Colombia!

China Signs 251MW Solar Project in Santander, Colombia!

Will Sodium Batteries Overturn Lithium Batteries' Dominance?

Will Sodium Batteries Overturn Lithium Batteries' Dominance?

Attention! Major Adjustments to Export Tax Rebate Policies in Early 2026!

Attention! Major Adjustments to Export Tax Rebate Policies in Early 2026!

IEA: Solar Power to Account for 40% of Global Electricity and New Jobs in 2024

IEA: Solar Power to Account for 40% of Global Electricity and New Jobs in 2024

The United States added 11.7 GW of new solar capacity in the third quarter!

The United States added 11.7 GW of new solar capacity in the third quarter!

Investment of Approximately $200 Million! Turkey Signs Agreement for 2.5GW !

Investment of Approximately $200 Million! Turkey Signs Agreement for 2.5GW !

South Africa's Largest Single-Site PV Plant—Mooiplaats 240MW PV Plant's PV2 Zone Officially Energized

South Africa's Largest Single-Site PV Plant—Mooiplaats 240MW PV Plant's PV2 Zone Officially Energized

China Energy Engineering Group's First New Energy Investment Project in South America Lands in Brazil

China Energy Engineering Group's First New Energy Investment Project in South America Lands in Brazil

Bacolod 65MW Photovoltaic Project Completes Reverse Power Transmission!

Bacolod 65MW Photovoltaic Project Completes Reverse Power Transmission!